20 Feb 2024

No matter what type of Self Storage Investor you are, the first thing that comes to mind is: Location. Whether you’re an Operator, Developer or Flipper the goal is to find an area where you have faith that your investment will lead to profitable growth. With a combination of Post-Pandemic price decreases and REIT pricing tactics finding perfect locations has become more interesting, to say the least.

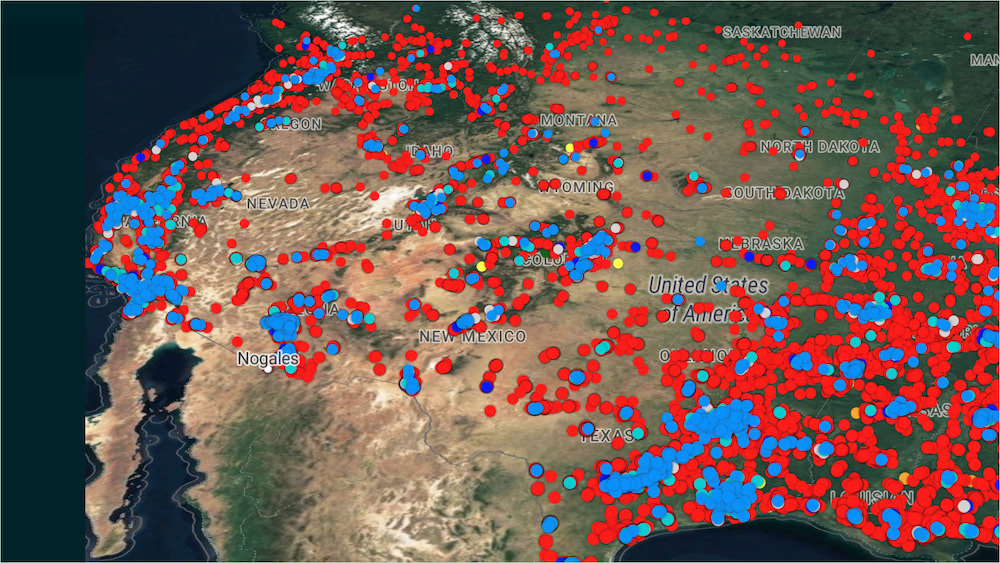

As contradictory as it sounds one of the ways we are seeing positive results - when hunting for locations - is primarily focusing on Rate Distressed Regions. Regions where pandemic prices shot up to 50 year highs, REITS descended like locusts and are now spewing out negative - in double digit figures - rate data points. Our thesis is simple: numbers don’t lie, but they don’t always tell the truth.

What do we mean by ‘numbers don’t always tell the truth’? Maybe more accurately we mean that you should look beyond the numbers and factor in plot lines surrounding the numbers. Let’s take a look at a specific example: how people tend to move in general.

The city where someone spent 20 years might not be yielding the job they need to survive. The kids might have graduated college and it’s time to move into a smaller home. Whatever the circumstances, the point being that when moving out of their current Region people tend to move 20 - 30 miles away, not 1000 miles. If downsizing and displacement isn’t the factor, and you’re simply looking to move for a change of scenery, people still tend to move close to where they originally grew up. It’s human nature, we are territorially driven creatures of habit.

Rates start dropping in the centralized regional area because demand is dropping from the all time highs seen during COVID-19. Looking 20-30 miles in surrounding areas where the movers end up living, we can see pockets of rate demand increases. Hint: People moving into a surrounding area might not want to unpack all of their belongings if downsizing; or conversely if recent college graduates are moving back in with their belongings and they are upsizing. Demand rising, rates increasing either way.

Another example of looking beyond the numbers: factor in infrastructure changes that are taking place outside of the central Region and we see even bigger pockets of growth. Changes such as highway expansions - easing commuting distances. Housing developments starting in locations that up until now were not zoned for Residential properties. Amazon fulfillment centers popping up in a mall that has been dormant for the last 15 years (see: Amazon North Randall Fulfillment Center in Ohio).

Go through Regions that seem to have depressed Rates currently and move your search out in a 15-20 mile radius. For Example: The Philadelphia Region might be showing a YoY decrease of -24%* from 2023-2024 today, but if you use this ‘depressed’ Region as a starting point, apply some of the outside factors we mentioned, you might actually be able to Strike Gold In a Copper Mine!!

Want to see more? We have a Webinar coming up that goes over this topic and actually drills deeper into data points needed to find your next investment location. Sign Up today: radiusplus.com/webinar/investing-in-self-storage

*10x10 CC for all REITs