15 Jul 2025

Self Storage demand is a difficult thing to quantify. For years the thesis was that the higher the rental rates the stronger the demand for Self Storage. However, with demand softening over the past 18-24 months due to a frozen housing market combined with a bloat of new supply suppressing asking rates in many markets while supply leased up- many top operators lowered Web Rates considerably to make renting a self storage unit more attractive and then recouped their initial discounting by raising the in place rates aggressively through Existing Customer Rate Increases (ECRI’s) to reach projections.

This shift in pricing strategy made Web Rates a less reliable indicator of demand as developers and acquisition groups struggled to understand the real upside of a deal with web rates being so low. While this trend seems to be reversing, with the REITs pumping the brakes on their heavily discounted web rates and the spread between the web and advertised in-store rates on their web pages shrinking, the Radius+ team is continuously trying to understand ways the industry can capture and quantify demand for Self Storage.

This week, we teamed up with John Reinesch and Christine King from the self storage digital marketing agency StorIQ to see what the correlation between Google Search Volume for Self Storage and related keywords was in relation to web rates.

We took a look at two different markets and pulled the monthly search volume data for the keyword “storage units near me”. This data shows the number of people that search for storage units near me each month and the change since June 2023.

Both had positive trends for Google search volume:

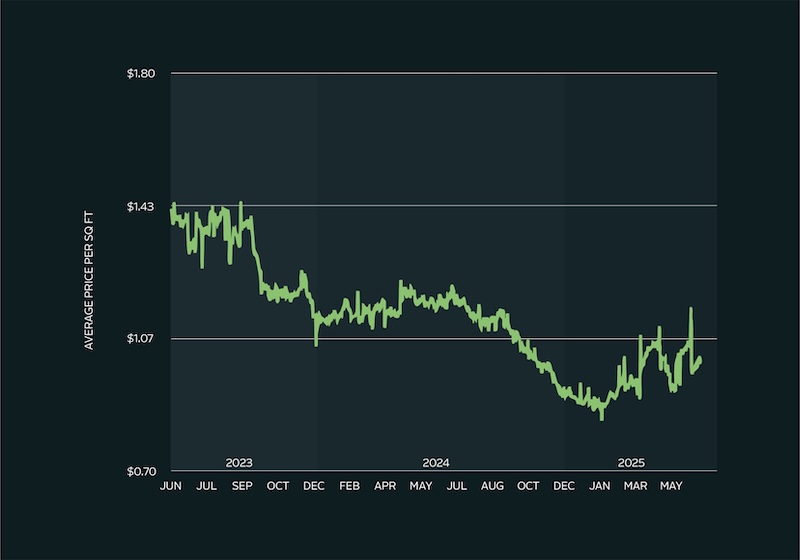

This Market was interesting as search volume hit a 2 year high in Q2 of 2025.

rates are pulled from Big 3 REITs 5x5, 5x10, 10x10, 10x15, 10x20 for NCC and CC

While this spike in demand did seem to show up in the web rates, it didn’t seem to effectively drive rates higher year over year, the way we expected it to.

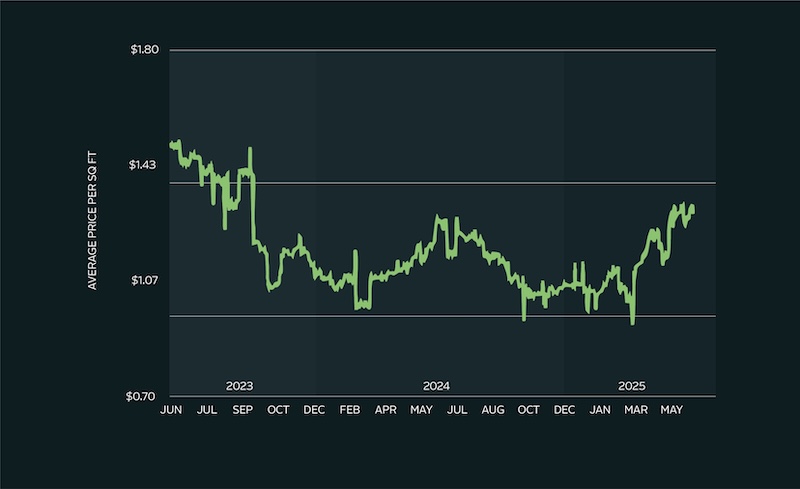

Market 2 followed a seasonal trend with search volume surging during the summer lease up season each year (with the exception of 2023 seemingly)

This seasonality showed up in the rental rate trends- where the Summer of 2025 seems to be on track to result in a strong year over year increase following the trends we saw in the google search volume.

Two markets with positive trends in google search volume led to different results in their web rate numbers. While the overall trend was there as is expected with Self Storage in general, we had to dig deeper to see why the first market didn’t see the same amount of rental rate highs market 2 did.

The answer, or at least a part of it lay in the new supply added in each market.

This disparity in supply in lease up is likely the reason why despite a huge jump in search volume Market 1 was seen to still have softer rates when compared to market 2.

Looking forward to continuing to refine these studies to try and determine a way to quantify the impact that search volume has on web rate trends.

StorIQ help drive measurable growth for self storage owners by maximizing move-ins and scalability. They act as a true partner that helps convert quality traffic into high-value tenants so our clients can scale with confidence. With over a decade of experience in digital marketing and customer acquisition, John Reinesch developed a process for building marketing strategies that deliver move-ins on autopilot. John has used this exact process to successfully grow his clients' self storage businesses and his own business.