28 Nov 2023

In the coming months there are two big barriers that are slowing down new developments. It is currently a hostile lending environment, with the collapse last year of Silicon Valley Bank (SVB) and New York’s Signature Bank, financial institutions have been hesitant to lend large sums of money at all to capital projects. Combined with high interest rates, getting deals to pencil has become increasingly difficult.

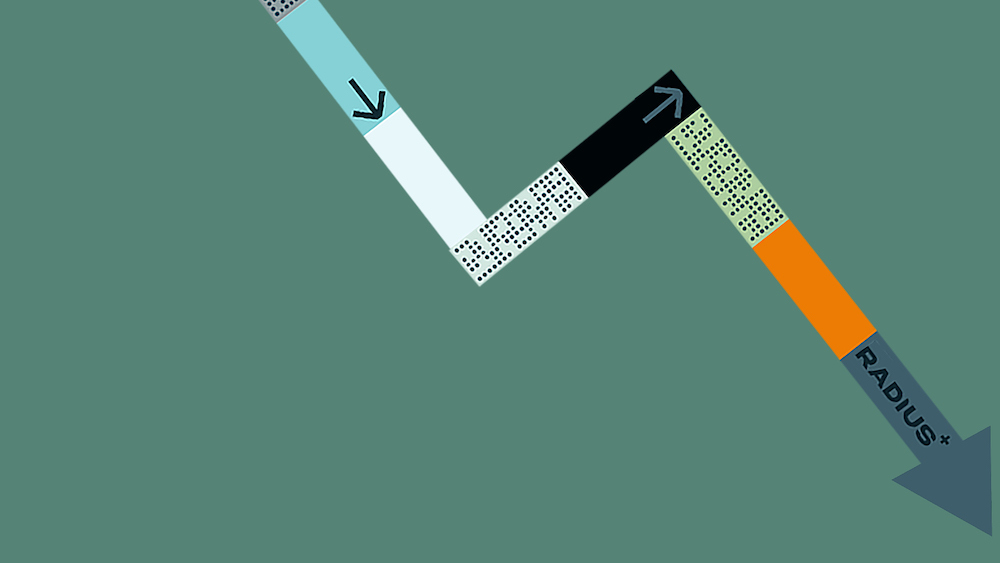

The other reason is the new REITs pricing strategy. Rates have been decreasing significantly in the past couple of months with the year to date average price per square foot* being $1.44, a 15.6% decrease YoY compared to the same time frame last year which was $1.7. While the REITs may have a large enough war chest to make a long term pricing strategy pencil for them, many other franchises do not. Decrease in asking rates, causes facilities to take a much longer time to become stabilized and profitable, which in turn leads to a longer timeframe for developers to see a return on their investment. This increased timeline has kept lots of developers from getting deals over the goal line.

The silver lining of all this is that the developers who are able to still keep finding deals despite the obstacles presented will find themselves dealing with significantly less competition. The facilities that are already up and running will also be able to see themselves not having to deal with as much new competition popping up around them competing for supply.

*based on 10x10 CC units from the REITs in the top 25 markets.