15 Jun 2018

When evaluating a self storage investment, the industry obsesses with analyzing square footage per capita of a market. As we discussed in our article "Is Basement Concentration the overlooked metric in self storage analysis?" we believe that investors are at best over-reliant on the metric and at worst misuse it. Other more appropriately analyzed metrics include, household income, household value, occupancy and absolute rental rate levels. These are great metrics to understand the current health of a market. For example, high occupancy and high rental rates likely means the market is quite healthy. This is a great starting point and should should be analyzed in any market study; however, they lack telling us which direction the market is headed.

Year over year changes in rental rates appear to be the most overlooked metric when analyzing a self storage market. It is particularly surprising because the data is so readily available right down to the micro market. Price is the clearing mechanism for supply/demand balance; therefore, we can determine the health of a market by analyzing the growth rates of rate. For example a market with declining rental rates likely has lower occupancy than a market with increasing rates.

While this metric isn't a silver bullet it can provide valuable insights into not only the health of a market but the direction of market health.

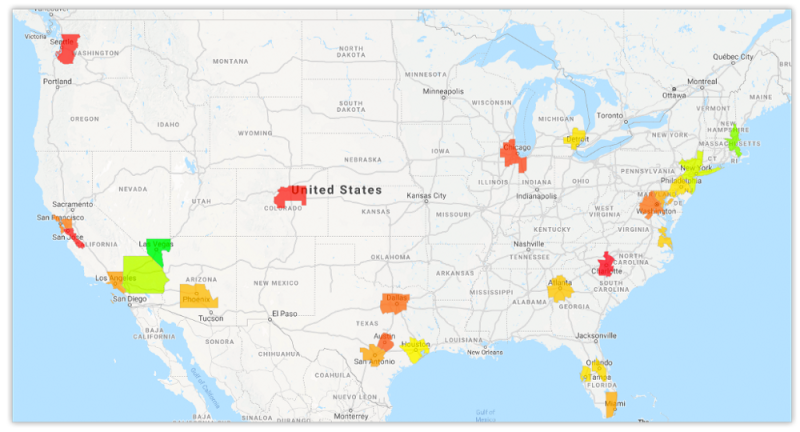

Understanding where a market is headed is just as important as understanding the current health. Declining rates indicate over supply and likely signal a tougher operating environment in months/years to come. The opposite can be said of increasing rates. In the chart below we see that Las Vegas, Riverside and Boston are all experiencing supply shortage and therefore seeing increasing rental rates. Conversely, Denver, Charlotte and Chicago are experiencing declining fundamentals. Rental rate growth is an excellent metric to give us a quick snapshot of the direction of market health.

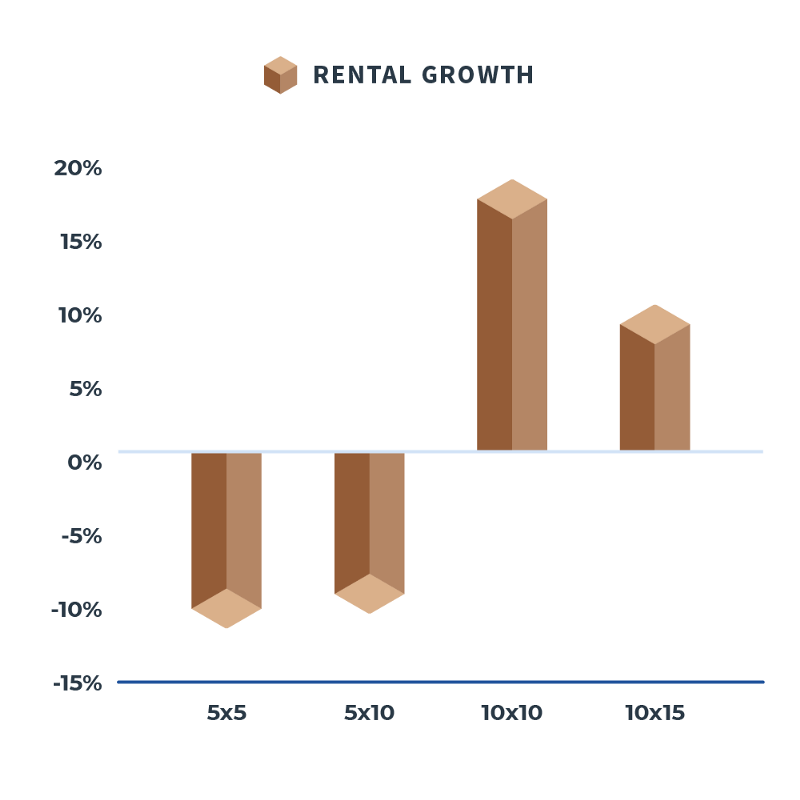

It doesn't end there! Rental rate growth can also be used to help you determine unit mix. Currently the market analyzes the spread between the price per square for of the different unit sizes. A wide spread would indicate the larger units are under supplied and vice versa. While this is a great methodology, the "normal" spread differs from market to market and may not tell the whole story. In the example below, we show that the larger units are under supplied and seeing rental rate growth while the smaller units are over supplied and seeing rental rate decline. This is excellent analysis to run to give yourself and your investors added confidence your mix will produce the right returns.