04 Feb 2026

This week the Radius+ team took a closer look at the Pittsburgh, PA CBSA.

Pittsburgh has experienced measured supply growth in recent years, maintaining a healthy balance between new construction and demand. Local municipalities have made efforts to diversify the region's economy beyond its traditional steel manufacturing base. These initiatives position the market for gradual job and population growth, which supports long-term rental rate improvements. As new supply deliveries slow, Pittsburgh is better positioned to benefit from this diversification. The market should continue to show stable performance as fundamentals strengthen.

Pittsburgh's transformation from a steel manufacturing hub to a more diversified economy has been a multi-decade effort. The region has successfully attracted technology companies, healthcare institutions, and educational facilities, creating a more resilient economic base. This diversification reduces the market's vulnerability to sector-specific downturns and supports steady population growth.

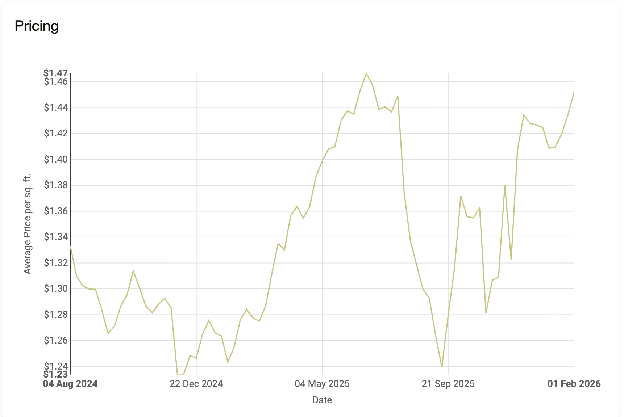

The measured supply growth observed over the 2022-2025 period reflects a market that has avoided the overbuilding seen in some other metropolitan areas. With new construction slowing and demand holding steady, Pittsburgh's multifamily market is positioned for improved fundamentals. This balance creates favorable conditions for rental rate growth as occupancy rates stabilize.

As Pittsburgh continues its economic evolution, the multifamily market should benefit from steady, sustainable growth. The combination of measured supply additions, economic diversification, and stable demand creates an environment where operators can pursue gradual rate increases without facing significant new competition. The market's stable performance trajectory makes it an attractive option for long-term investors seeking consistent returns.