10 Sep 2020

Risk is a strategy board game in which the goal is to take over the world. Ok, so no one is going to take over the world by buying a self storage property. However, knowing how to calculate and take risks at the right moment can be the difference between success and failure.

With the continued uptick in demand and limited supply, 2019 brought tighter returns on stabilized properties. Facilities selling Upon Completion of construction or at Certificate of Occupancy (C of O) became attractive for investors looking to achieve higher rates of return by taking on the added risk of lease-up. However, as 2020 approached, absorption levels in many markets were slowing as threats of stagnant rent growth and over-supply were becoming more prominent.

These shifting parameters made determining the market value of a property at C of O challenging. The disconnect between the perceived risk of lease-up between developers and investors was becoming more pronounced. Investors were demanding a more exhaustive analysis of the property and the surrounding marketplace, including: population density, saturation levels, market occupancy levels, residential developments in the marketplace, proposed self storage projects in the pipe-line or in lease-up and whether rents were growing, flat or being discounted to compete with other properties.

Brokers/Investors surveyed (Pre COVID-19) reported that the following spreads in capitalization rates for a stabilized property versus a property at C of O:

Overall, the spread predicted between a stabilized property and a property at C of O ranged from 75bps-250bps.

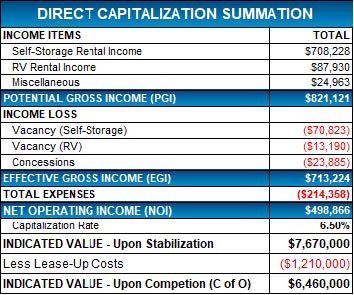

As an appraiser, when determining the value of a proposed property within the Income Approach, we typically derive the stabilized value of the property by taking the potential gross income and stripping out market vacancy, concessions & credit loss and market expenses to determine the Net Operating Income (NOI). The NOI is then divided by the cap rate to determine the stabilized value.

To derive the Upon Completion or C of O Value, we deduct the following from the stabilized value:

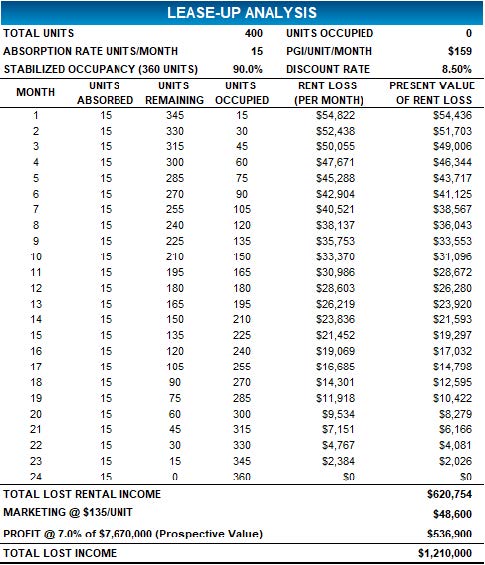

We will utilize the case study below to reflect how the different approaches support the spread in value between a stabilized property and a property Upon Completion (C of O). The proposed facility below was anticipated to have 400 units, with a market occupancy of 90% and absorption levels of 15 units per month.

The total lost income associated with the lease-up is deducted from the stabilized value to determine the value Upon Completion (C of O):

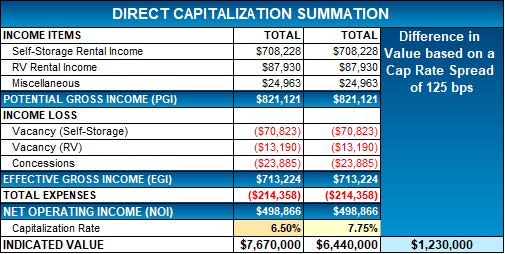

As a test of reasonableness for the assumptions made in the direct capitalization table above, we have taken into consideration the spread (75-250 bps) the brokers surveyed had predicted for a Stabilized property versus a property Upon Completion (C of O). The risk factors associated with the property above (location/ saturation/market occupancy/proposed self-storage properties/ etc.) were determined to be at the low-end of the range and thus a spread of 125 bps will be utilized.

As shown in the graph above, the 125 bp spread in cap rates reflects a difference in value of $1,230,000, which is similar to the previously documented lease-up costs of $1,210,000. It should be noted that if the perceived risk associated with the lease-up were higher, then both the allocated % of entrepreneurial profit and the cap rate spread would increase.

It is prudent to note that the COVID-19 virus (aka coronavirus) is a serious illness that is currently developing throughout the world and more specifically the United States. The effects thus far include volatility in the stock and capital markets. The impact to demand and ultimately values for real estate is also developing. Estimating the impact of the COVID-19 virus (aka coronavirus) on market values is currently subjective since there is limited market evidence. Although we do not want to overstate the implications to value, we need to take into account the tightening of liquidity, the added risk of maintaining occupancy and the potential decrease in effective income.

Based on discussions with numerous market participants the market for C of O property sales has been deeply impacted by the COVID-19 virus. Some sentiments include:

Calculating risk has always been a challenge and C of O deals have always carried the inherit risk associated with lease-up. However, these levels of risk are now compounded by the uncertainty associated with the impact of the COVID-19 virus on the real-estate market. It will be interesting to see how the players in the self-storage market strategize to ensure success. Right now, it seems that the risk-adverse will be standing on the sidelines and only a brave few, with a high-risk tolerance, will be entertaining C of O deals and the promise of higher returns.

Thumbnail: TheSpruceCrafts